In this How to Buy Bitcoin on eToro guide I will cover all the basics of how to buy Bitcoin on eToro as well as highlight what to look out for. Furthermore, I will offer you some tips and tricks to get the best value for money and transact in a safe secure manner.

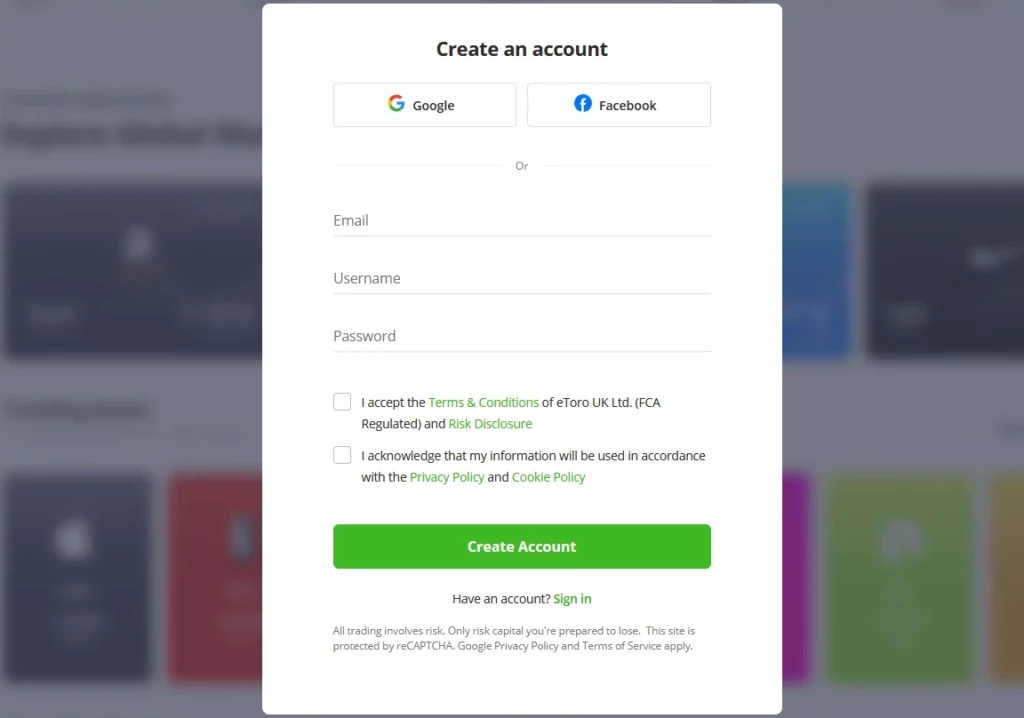

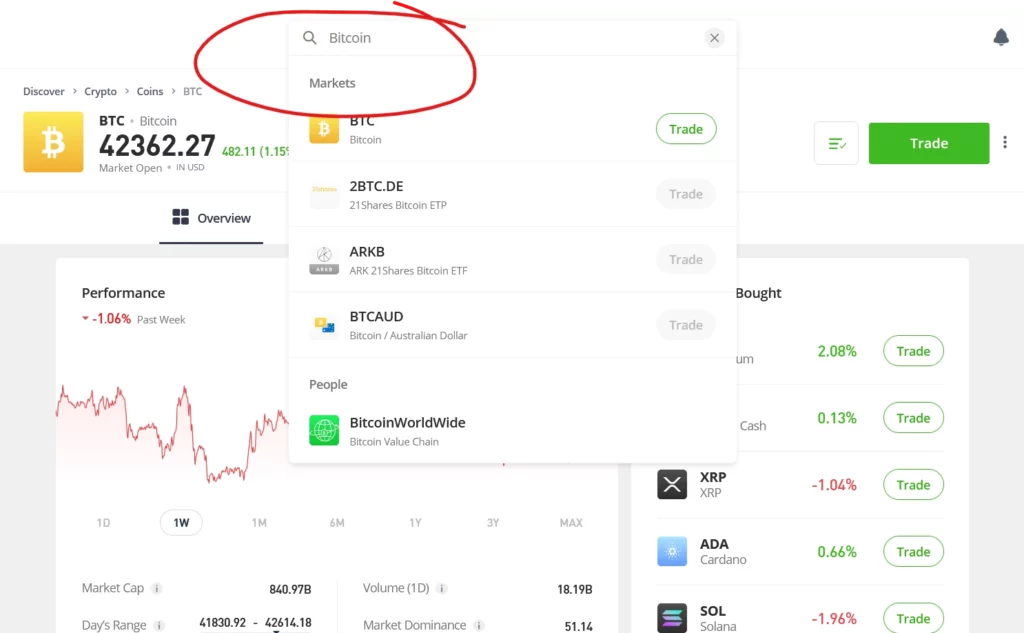

In short, the process is much the same for many platforms. The steps are usually

How Do Authorities Tax Bitcoin Trades?

Bitcoin is considered property for tax purposes in many countries, including the US. This implies that profitable trades should be reported as capital gains, while losses are treated as capital losses.

TIP: Use crypto tax software to help you report accurately – Read More…

In the US, the IRS mandates that traders report trade values and cost basis in USD. The IRS views assets held for over a year as subject to long-term capital gains rates, while short-term trades are taxed at ordinary income rates.

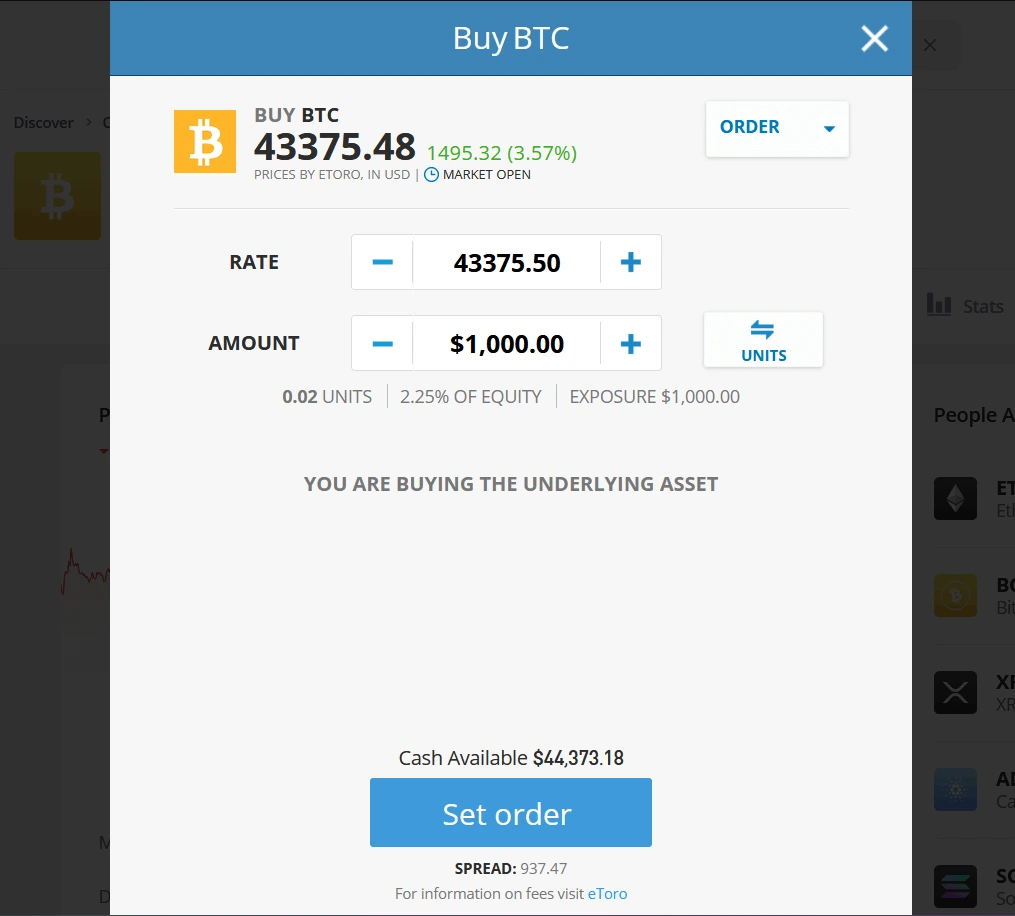

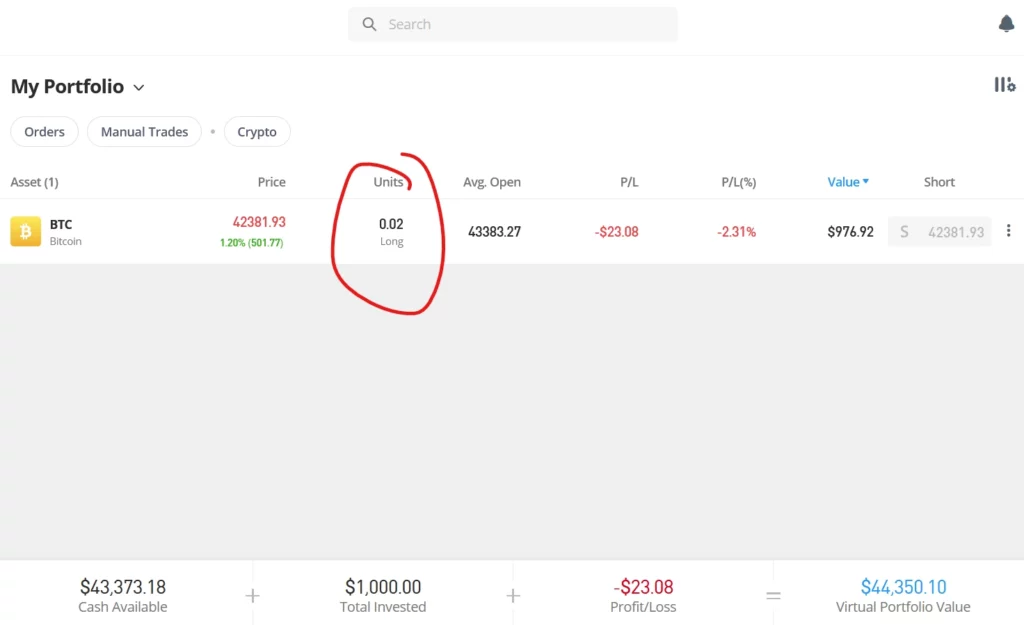

Fractional Bitcoin Investments

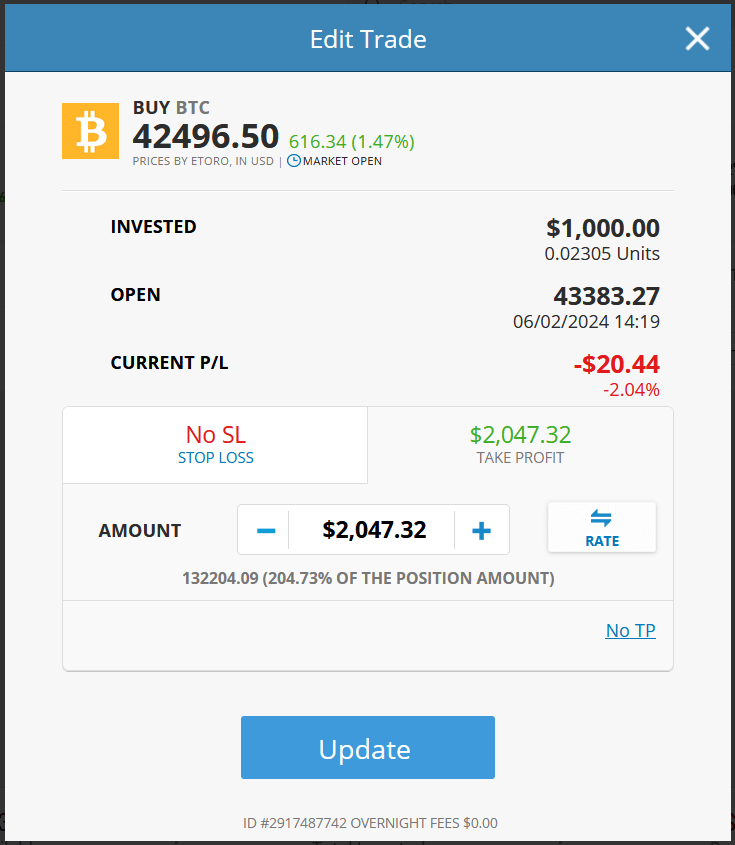

Bitcoin’s code guarantees scarcity by capping the maximum number of bitcoins at 21 million. Each of these currently trades for over $40,000.

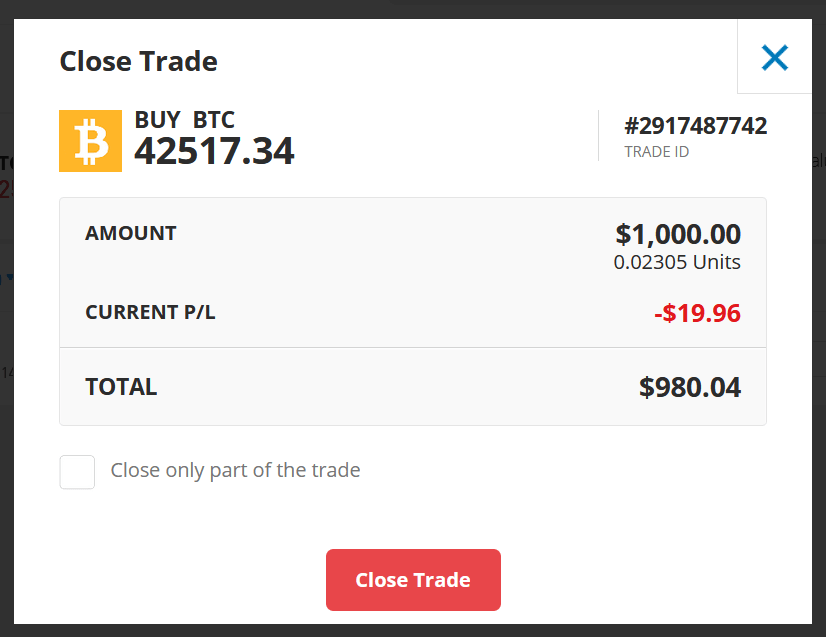

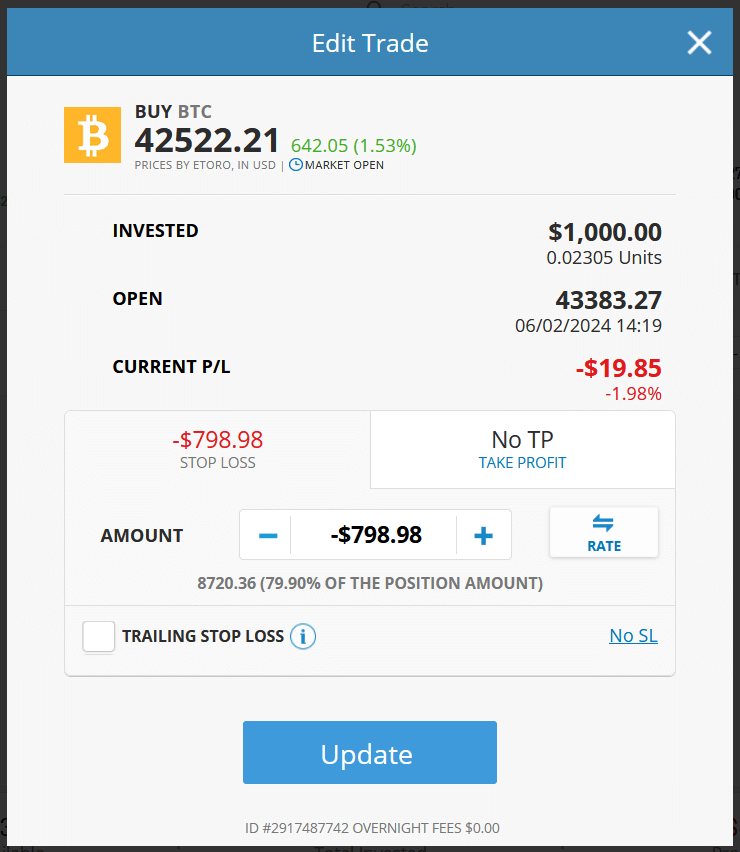

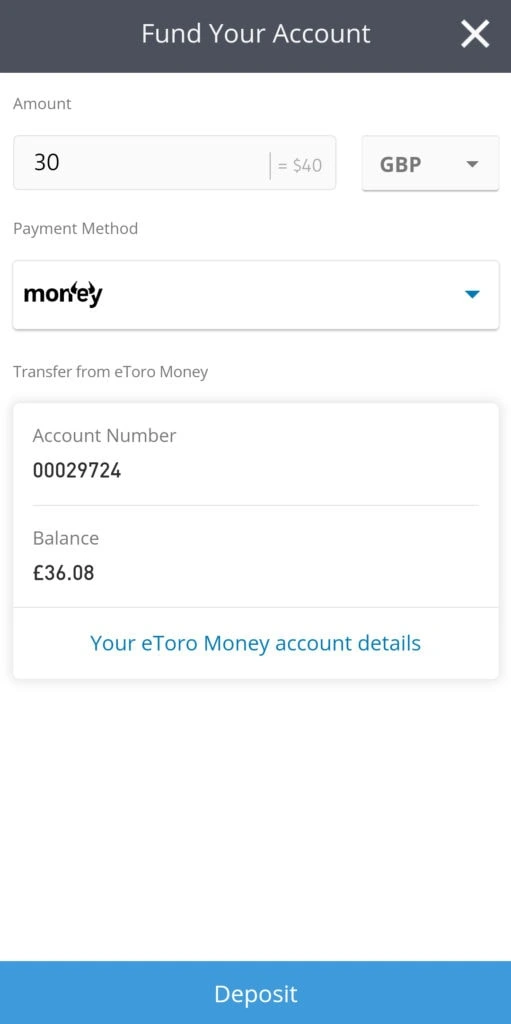

However, on eToro, you have the flexibility to purchase as little as $10 worth. While Bitcoin’s maximum supply is limited, it is divisible, enabling you to acquire smaller amounts.

Moreover, eToro offers support for fractional shares of stocks and ETFs, further expanding your investment opportunities.

FAQs About Buying Bitcoin on eToro

Is eToro safe to buy Bitcoin?

eToro has got you covered with a solid regulatory framework. They have registered with big players like FinCEN in the US and the FCA in the UK. Plus, they’ve got your back with SIPC insurance for stocks, ETFs, and options, and FDIC insurance for US cash balances. Your trading experience is secure with eToro!

Can you buy actual Bitcoin on eToro?

Sure! When you purchase Bitcoin on eToro, you have the option to withdraw it to an external wallet. From there, you can use or send your Bitcoin to another wallet.

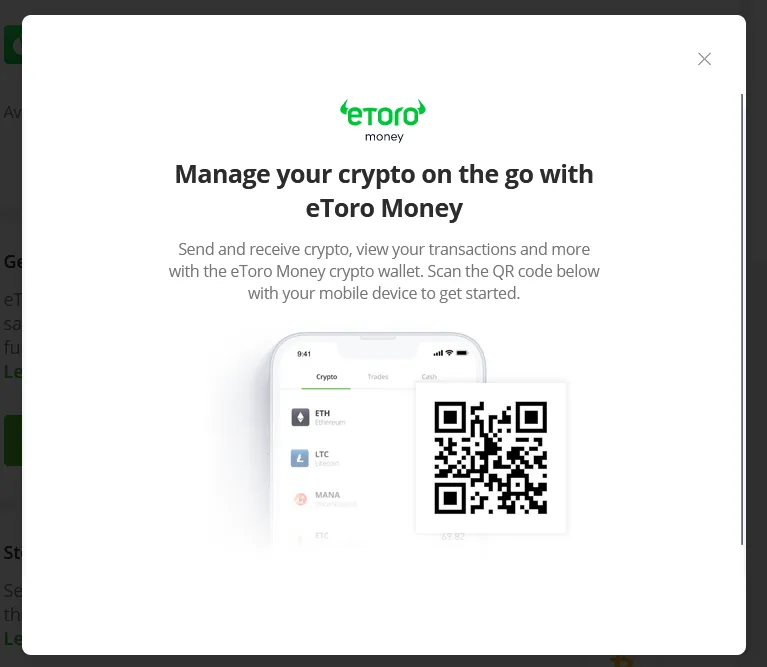

Can I transfer bitcoins to eToro?

At present, it is not possible to transfer bitcoins to the eToro trading platform. Nevertheless, the eToro Wallet allows you to receive bitcoins seamlessly.

How do I withdraw Bitcoin from eToro?

To withdraw Bitcoin from eToro, simply choose the BTC position from your portfolio and click on “withdraw.” Please note that only the eToro Wallet is compatible for withdrawals. Alternatively, you can sell your position and withdraw the earnings to your funding source.

How can I cash out from eToro Wallet?

To withdraw funds from your eToro Wallet, you have the option to transfer your bitcoins to another wallet or exchange. Unfortunately, at present, there is no method to return Bitcoin to the eToro trading platform to close your position.

Where does eToro store Bitcoin?

eToro securely stores the majority of crypto assets in cold storage. Cold storage refers to crypto wallets that are offline and not connected to the internet. This robust security measure ensures the safety of your digital assets.

Conclusion

eToro’s user-friendly platform is ideal for individuals looking to learn the art of investing in Bitcoin and other cryptocurrencies. With an extensive range of stocks and ETFs available, it enables the creation of a diversified portfolio to effectively manage risk. Seamlessly trade crypto alongside stocks and ETFs.

A competitive 1% trading fee ensures cost-effectiveness, while trading tools such as Copy Trading, Smart Portfolios, and a $100,000 demo account offer an opportunity to learn the ropes without being an expert trader.

Let me know what you think of eToro in the comments below!

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong

-

- Stocks: Over 3,100 tradable stocks

- Exchange-traded funds (ETFs): Over 350 choices, including index ETFs and sector ETFs

- Crypto: Select from a range of sought-after assets like BTC and ETH, or opt for trading favorites such as DOGE and SHIB.

Additional choices are accessible in various parts of the globe.

-

- Currencies (forex trading)

- Commodities (Oil, gold, wheat, and more)

- Options trading

- Leverage trading (TIP: Please be careful, most people lose when leverage trading regardless of the platform)

Automated Trading Tools and Features

eToro makes basic trades super intuitive and also gives you the option to put your trading on autopilot.

Two main features let you invest without making manual trades.

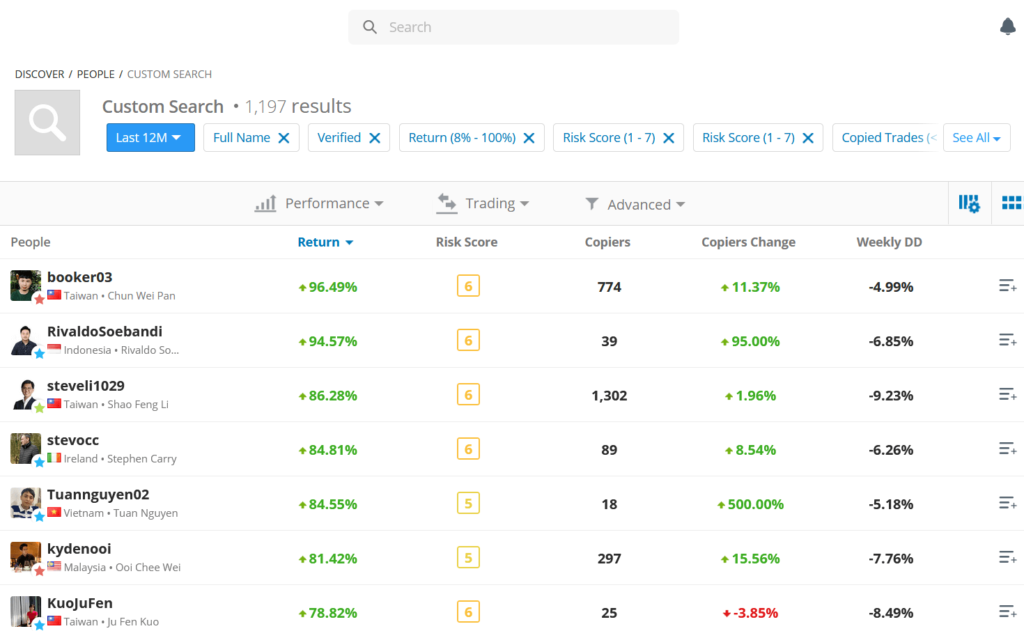

- CopyTrader

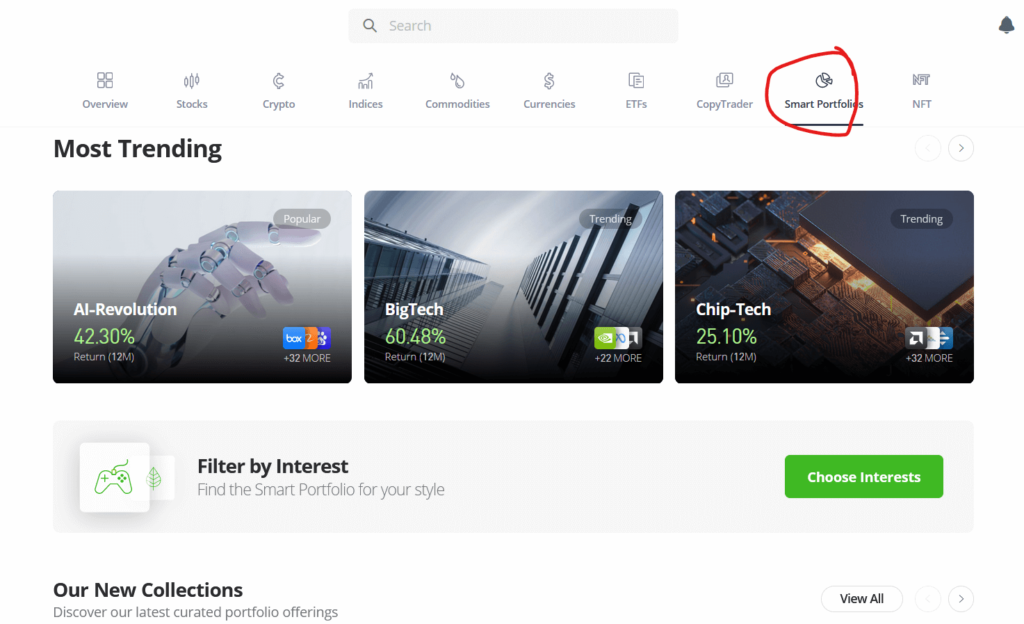

- Smart Portfolios

I mentioned CopyTrader before. It’s a cool feature that lets you follow the moves of top traders on the platform. You can check out their performance history and bios, and even take a look at their recent trades or portfolios. If you find a trader you like, you can start following them in just a few clicks. Just remember, that CopyTrading requires a minimum investment of $200.

When you set up a copy trade, you can also set a trigger to exit the position. This helps you cut your losses if the market goes against your trade. So, you’ve got a backup plan! 😉

Smart Portfolios, previously known as Copyportfolios, function similarly to ETFs by targeting specific sectors or investment objectives. For instance, the @Crypto-currency portfolio tracks the value of the two top cryptocurrencies, BTC and ETH. In contrast, the @Big-crypto portfolio expands the selection to encompass 19 cryptocurrencies. While BTC and ETH account for 40% of the portfolio, the remaining 60% provides exposure to other prominent crypto assets.